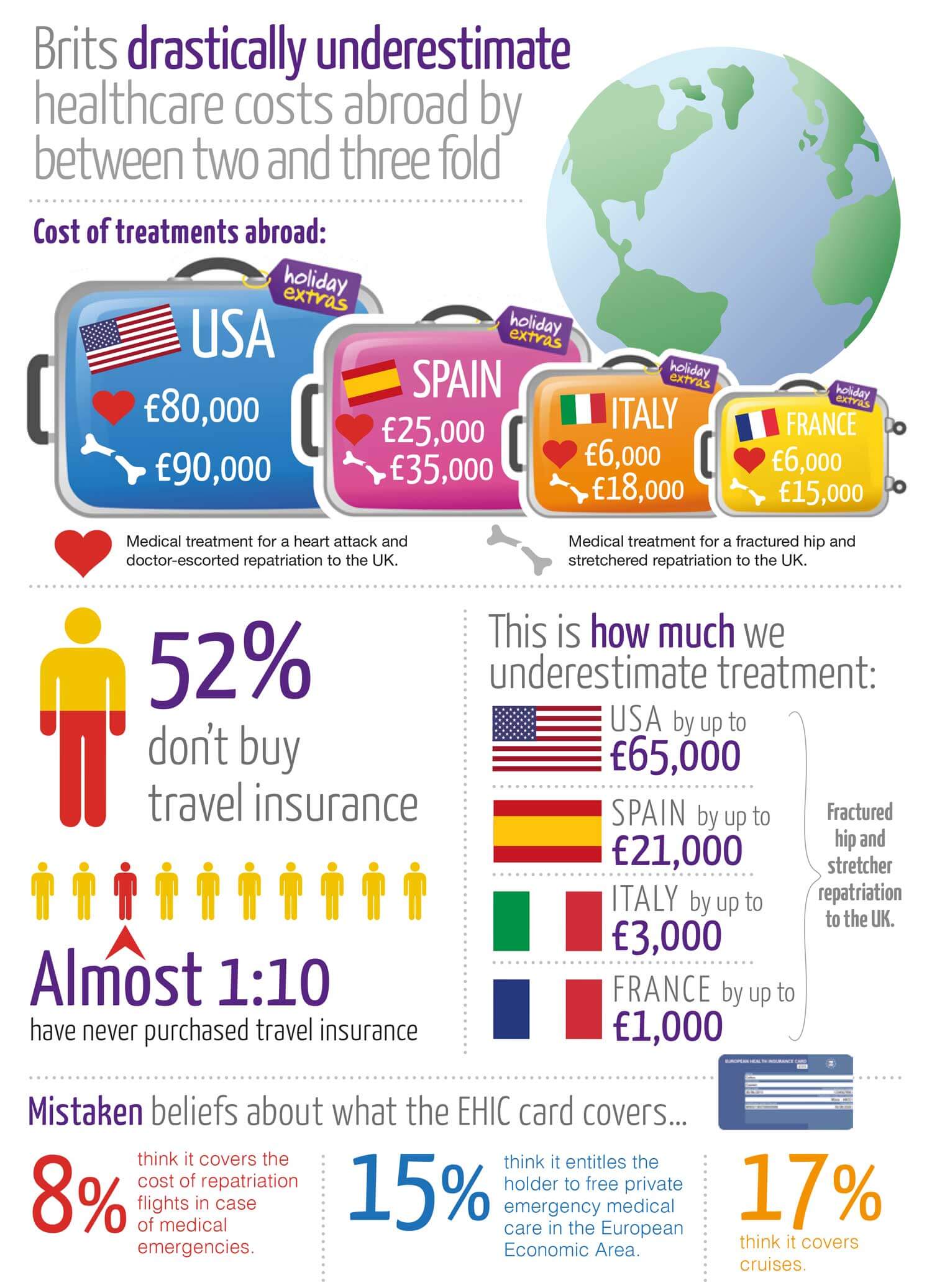

Brits Drastically Underestimate Healthcare Costs Abroad

Half of Brits don't purchase travel insurance | US medical treatments underestimated by up to £65,000 | Spanish medical treatments underestimated by up to £21,000

Code to share this infographic

Travel Insurance Misconceptions

With the summer holidays just around the corner, new research* has exposed worrying disparities between the perceived and the real costs of holiday healthcare, as well as confusion over what the EHIC card actually entitles travellers to. In light of the findings, HolidayExtras.com warns that many holidaymakers are potentially exposing themselves to crippling financial costs in the event of an accident or illness while away.

What are the actual costs?

The research revealed alarming shortfalls when comparing 2,000 Brits' perceived cost of treating specific medical emergencies in popular tourist destinations** against the actual costs*** of treating those emergencies. When asked to predict the cost of medical treatment for a heart attack and repatriation to the UK from Spain, those polled estimated the cost to be over £10,000 lower than the reality; an estimated average cost of £14,278 against an actual average cost of £25,000. A worrying statistic when treatment and doctor-escorted repatriation following a heart attack is the most common medical treatment needed by Brits abroad in their five most visited countries**. Similarly, those surveyed thought the cost of treatment for a fractured hip and travel back to the UK to be just under £14,000, compared to an actual cost of £35,000 - a discrepancy of over £21,000.

Travelling to the US?

The disparities are even larger for non-European countries. For treatments in the USA, respondents thought the costs to treat the two medical emergencies to be £26,000 and £24,000 respectively - some £54,000 and £65,000 under what the actual costs are estimated to be.

Fourteen per cent of holidaymakers leave it right until they get to the airport before buying their foreign currency, with nearly two thirds (62%) of men admitting that they never even bother to compare exchange rates! Alarmingly, 15% of those surveyed admitted that they go on holiday without any travel insurance, and 8% of 25-34 year-olds confessed that they had been on holiday without getting the recommended inoculations.

Brits underestimating costs by between two and three fold

Medical costs closer to home also proved difficult for Brits to anticipate, with the average estimate to treat a heart attack and travel home from Ireland more than £4,000 under-valued, and the cost of treatment and travel home following a hip fracture predicted to be less than half the actual cost; £25,000. Overall, it appears that Britons are underestimating the cost of healthcare by between two and three fold.

Over half of Brits don't purchase travel insurance

The study, run in conjunction with Healix Insurance Services Ltd., revealed that over half (52%) of those polled don't purchase travel insurance every time they go away and nearly one in 10 (8%) has never purchased travel insurance, revealing a perturbing scenario for many jetting off abroad.

Ant Clarke Cowell, Communications Director at HolidayExtras.com, explains:

"Travel insurance is often overlooked as an unnecessary purchase but healthcare is expensive, and in the event of illness or accidents holidaymakers can be dumped with unaffordable fees. Nearly one in ten (8%) thinks the EHIC card covers the cost of repatriation flights in case of medical emergencies, 15% incorrectly believes the EHIC card entitles the holder to free private emergency medical care in European Economic Area (EEA) countries, and 17% think it covers cruises."

"It's so important that travellers are made aware of the unnecessary financial risk while on holiday. The only way to protect yourself is to sort travel insurance in advance that offers cover for all of the activities you'll be doing while away, and covers the countries you're visiting. Ensuring you're insured will also provide you with peace of mind, which is essential for any holiday"

Established travel writer and journalist, Andrew Eames, said:

"In a long career as a travel writer, I've been grateful for the support provided by my travel insurance on several occasions. A few of my adventures could have easily turned sour without insurance cover. But even as a so-called travel expert, I am guilty of not paying enough attention to the level of cover that policies provide. I would urge travellers not only to make sure they are insured but also that they have the right cover in place."

For more information on travel insurance, there is a wealth of information at HolidayExtras.co.uk

*2,000 UK adults polled by Vital Research and Statistics on behalf of HolidayExtras.com in April 2016.

**Using the latest ONS Travel Trends report, 2015

***According to Healix Insurance Services Ltd data

More helpful links & resources

We've been helping travellers get organised for their holidays for 32 years now.

Buy before you fly

Booking in advance can save you pounds

-

Airport Parking

Save £'s on the gate price. -

Airport Hotels

Convenient if you're traveling with kids. -

Rail / Coach / Car Hire

Alternative transport if you don't want to drive. -

Holliday Insurance

Complete protection for your trip. Under 18's go FREE. -

Airport Lounges

Relax away from the crowded terminal. -

Port Parking

Perfect for daytrippers, shoppers and holiday makers.